On July 26, 2024, the Swiss Financial Market Supervisory Authority (FINMA) issued its latest guidance, FINMA Guidelines 06/2024, focusing on the regulatory landscape for stablecoins. This guidance builds on FINMA’s 2019 framework and addresses the evolving risks and challenges faced by stablecoin issuers and the banks that provide default guarantees. With the rise of stablecoins as a prominent financial instrument, FINMA’s new rules aim to clarify legal classifications, enforce anti-money laundering (AML) measures, and outline the specific requirements for Swiss banks involved in stablecoin transactions.

Stablecoins are digital assets designed to maintain a stable value by being pegged to traditional currencies, commodity, or financial instrument. In Switzerland, stablecoins are increasingly used as a means of payment on blockchain platforms, offering the benefits of cryptocurrencies, such as quick transactions and decentralized management, while minimizing price volatility. For this reason, the demand for stable coins is growing worldwide. Globally, Stablecoins have a market value of $168 billion and occupy approximately 7.75% of the total market value of cryptocurrencies.

In our latest Insight, we answer key questions related to the new regulations from FINMA and the use of Stablecoins in business.

What new regulations do the new FINMA Guidelines include?

The new FINMA Guidelines 06/2024 introduce several important regulations regarding the issuance of stablecoins and the associated risks for financial institutions. These include:

✓ Legal Classification of Stablecoins

Stablecoins are generally classified as deposits under banking law or as collective investment schemes, depending on how the underlying assets are managed. The Anti-Money Laundering Act (AMLA) is typically applicable to stablecoins due to their intended use as a means of payment.

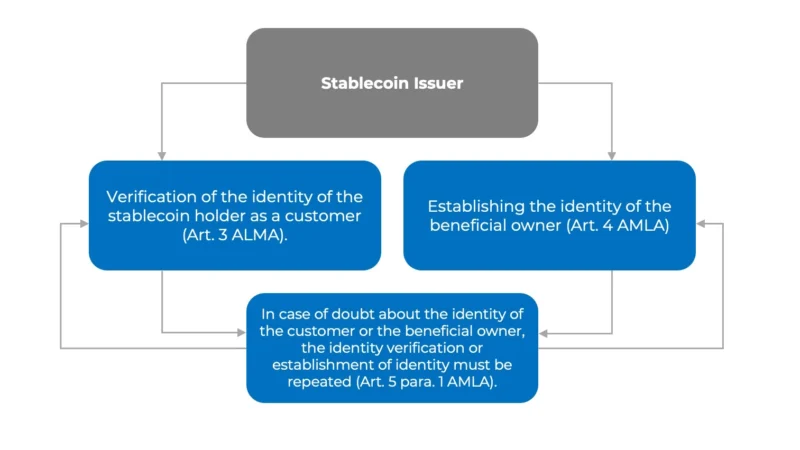

✓ Anti-Money Laundering (AML) Requirements

A stablecoin issuer is considered a financial intermediary for the purposes of AML legislation and is obliged to take the following steps:

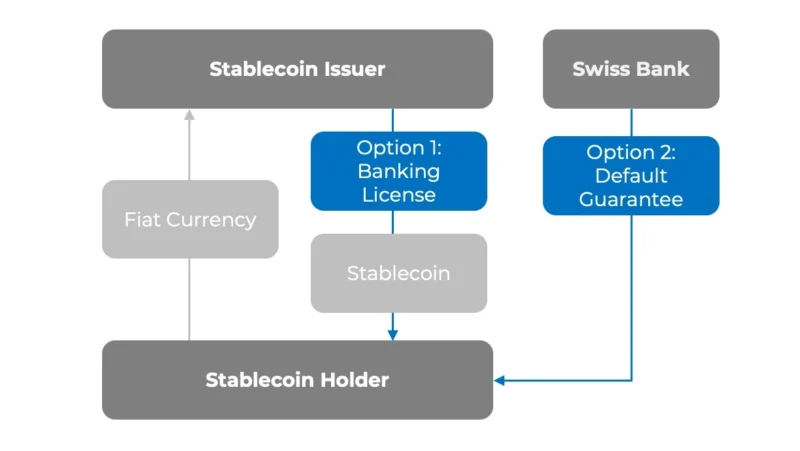

✓ Banking Law Regulations

Issuers of stablecoins that accept deposits from the public on a professional basis generally require a banking license, unless the deposits are guaranteed by a bank. The guidelines also address the risks associated with using default guarantees from banks, which may exempt issuers from requiring a FINMA license but still necessitate affiliation with a self-regulatory organization.

✓ Default Guarantee Requirements

FINMA outlines minimum requirements for default guarantees associated with stablecoins. These include ensuring individual claims for customers in case of issuer bankruptcy, covering all public deposits with the guarantee, and allowing for uncomplicated, rapid calls on the guarantee. These measures aim to protect depositors, though they do not provide the same level of protection as a banking license.

✓ Reputational and Legal Risks for Banks

Banks providing guarantees for stablecoins face potential reputational and legal risks if the issuer violates AMLA obligations. These risks are compounded by the possibility of dishonest stablecoin holders asserting claims against the bank in the event of issuer bankruptcy.

✓ Need for Regulatory Review

The Federal Council has recognized the need for action regarding the exceptions to banking law related to default guarantees. The guidelines suggest that these exceptions should be reviewed to ensure they provide adequate protection, and FINMA will work to address the associated risks in upcoming discussions.

What are the key differences between stablecoins and traditional financial instruments in terms of legal obligations?

Stablecoins differ from traditional financial instruments in terms of legal obligations due to their digital and decentralized nature. Traditional financial instruments, such as stocks, bonds, and savings accounts, are well-regulated and operate within established legal frameworks that include investor protections, disclosure requirements, and clear taxation rules. In contrast, stablecoins, while offering stability by being pegged to assets like fiat currencies, face unique challenges in classification and regulatory oversight. For instance, stablecoins may be treated as deposits, securities, or collective investment schemes, depending on their structure and purpose. This ambiguity necessitates additional regulatory scrutiny, particularly in the areas of AML and KYC, where stablecoins must implement robust identification and transaction monitoring processes. Unlike traditional instruments, stablecoins also require compliance with evolving digital asset regulations, which can vary significantly across jurisdictions, adding complexity to their legal obligations.

What are the tax implications for businesses issuing or trading stablecoins under current Swiss law?

The tax implications for businesses involved with stablecoins in Switzerland depend largely on the classification of these digital assets. If a stablecoin is categorized as a security or a deposit, it may be subject to capital gains tax, which applies to the appreciation in value upon sale or exchange. Additionally, stablecoin transactions might trigger VAT if considered taxable supplies of goods or services. Swiss businesses issuing or trading stablecoins must also consider withholding taxes on interest payments if applicable. The classification of stablecoins as securities could also lead to additional reporting requirements under Swiss tax law. As the regulatory environment evolves, businesses are advised to stay informed and work closely with tax professionals to ensure full compliance with current Swiss tax laws.

How do the new FINMA guidelines interact with international regulations on stablecoins, such as those from the EU or the U.S.?

The new FINMA guidelines on stablecoins intersect with international regulations by setting a higher bar in certain areas, especially in AML and KYC compliance. While the EU’s Markets in Crypto-Assets Regulation (MiCAR) and U.S. SEC guidelines provide comprehensive frameworks for digital assets, FINMA’s approach may impose stricter conditions, such as the requirement for Swiss banks to offer default guarantees that meet specific criteria. This alignment, or potential divergence, means that Swiss-based issuers must navigate both domestic and international regulations to ensure full compliance. The complexity arises from differing global standards, making it essential for businesses to develop adaptable strategies that consider the most stringent requirements from various jurisdictions.

What are the potential legal risks for businesses accepting stablecoins as a form of payment?

When using stable coins as payment in a business, there are several potential legal risks that could arise:

Regulatory Uncertainty: Varying legal classifications across jurisdictions may complicate compliance and enforcement.

AML/KYC Compliance: Failure to adhere to stringent AML and KYC requirements could result in severe penalties.

Contract Enforceability: Legal status and enforceability of contracts involving stablecoins may be unclear or disputed.

Volatility Risks: Even though stablecoins are designed to be stable, fluctuations in value can still present risks in pricing and financial management.

Technological Risks: Smart contracts and other underlying technologies could malfunction or be exploited, leading to potential losses.

In conclusion, the new FINMA Guidelines 06/2024 represent a significant step in regulating the fast-evolving world of stablecoins, providing much-needed clarity and imposing stricter requirements on issuers and financial institutions involved in this space. For businesses operating in Switzerland, the evolving regulatory framework presents both opportunities and challenges.

LINDEMANNLAW specializes in the rapidly evolving field of digital assets and financial regulations. Contact us today for personalised legal advice to ensure your business is fully compliant with the latest requirements.