The US estate tax can have significant implications for non-US persons who own US securities or property within the United States. Understanding how the US estate tax works is essential to minimize potential tax liabilities for your estate.

What is the US Estate Tax?

The US estate tax is imposed on the transfer of the “taxable estate” of a deceased person. The taxable estate includes the total value of the deceased’s assets, such as cash, real estate, personal property, and financial investments, minus allowable deductions like debts, funeral expenses, and charitable contributions. The US estate tax applies under certain circumstances to individuals who are neither US citizens nor US residents. For instance, a Swiss or French individual holding a portfolio of US stocks may be subject to this tax.

The US estate tax rate is progressive, meaning that it increases with the value of the estate. The top estate tax rate is 40% of the net value of the estate.

When Does the US Estate Tax Apply to Non-US Persons? Understanding US Situs Assets

Non-US individuals may be subject to US estate tax if they own certain types of property and the total value of these assets exceeds USD60,000:

✔ Stock in US corporations, including shares in US-registered investment funds (mutual funds or ETFs)

✔ US derivatives

✔ Real estate in the US

✔ Tangible personal property located in the US, such as artwork, vehicles, jewelry, office equipment, etc.

These assets are classified as US situs assets.

Additional US situs assets include interests in certain US partnerships or certain US debt instruments. Such assets require detailed analysis to determine whether the US estate tax applies.

The following asset categories are generally not considered US situs assets:

✔ US bank accounts not connected to US trade or business

✔ American Depositary Receipts (ADRs) of foreign corporations

✔ Proceeds from US life insurance policies on the life of a non-US person

How Does US Estate Tax Impact Your Estate?

If a non-US individual’s estate is subject to US estate tax—such as when the deceased person held US equities exceeding USD 60,000—the estate must be reported to the US IRS using Form 706-NA. The executor of the estate is responsible for filing this form within nine months of the date of death. A six-month extension is possible.

The US portion of the estate is taxed at a progressive rate ranging from 18% to 40%. Unlike US citizens and residents, non-US individuals do not benefit from high exclusion amounts and are subject to stricter tax thresholds.

How Can the Switzerland-US Tax Treaty Reduce Estate Tax Burden?

Switzerland has a double tax treaty with the US that mitigates the impact of US estate tax for Swiss tax residents. The treaty allows Swiss estates to benefit from a pro-rata portion of the exclusion amount available to US citizens and residents, calculated as follows:

Example:

✔ Total assets: USD 20,000,000

✔ US situs assets: USD 8,000,000

✔ Exclusion amount: USD 13,990,000

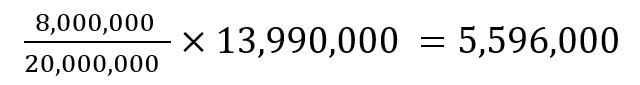

Exclusion amount applying to the estate:

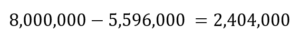

Taxable amount:

The taxable amount of USD 2,404,000 is then subject to the US estate tax rate of 40%.

This treaty significantly reduces the estate tax burden for Swiss residents compared to the standard USD 60,000 exemption for non-US persons. However, to benefit from the treaty, the worldwide estate must be disclosed to the IRS.

How to Legally Reduce or Avoid US Estate Tax?

There are several legal strategies that non-US persons can use to minimize their US estate tax liability:

✔ Avoid direct investments in US stocks – Instead, invest through a non-US investment fund that holds US equities.

✔ Utilize corporate structures – Set up a separate corporate entity for US investments.

✔ Life insurance – A life insurance policy can provide liquidity to cover estate tax obligations.

✔ Irrevocable trusts – Transferring assets into an irrevocable trust may remove them from the taxable estate.

By implementing these strategies, non-US persons can effectively reduce or avoid US estate tax exposure, ensuring a more tax-efficient transfer of wealth to their heirs.

The US estate tax can impose significant burdens on non-US individuals owning US assets. Understanding US situs assets, estate tax rates, and available tax treaties, such as the Switzerland-US estate tax treaty, can help mitigate tax exposure. Legal structuring through corporate entities, trusts, and life insurance can further reduce estate tax liability.

If you have US investments and are concerned about estate tax implications, consulting with an experienced estate tax attorney can help you develop a strategic tax plan. Contact us today for legal tax support.

Disclaimer:

The strategies and information provided herein are for general informational purposes only and do not constitute legal advice. Businesses should consult with a qualified attorney at LINDEMANNLAW for tailored legal advice specific to their individual circumstances and to ensure compliance with applicable laws and regulations.