Answers to the 5 most frequently asked questions

1. What is a securitization?

A securitization vehicle is simply a company with the purpose to hold any type of valuable assets and issue debt securities against these assets that represent the performance of such assets. The idea of a securitization is simple. It is a way to hold assets that may be cumbersome to hold directly (e.g. non securitized loans and other debt) or difficult to transfer (e.g. property or non-listed equity) in a transferable, bankable security. By creating a company solely for such purpose, there is no credit risk on the issuer, however fraud and operational risks remain. A careful selection of service providers and a diligent legal set up is key to minimize these risks. Also pledge arrangements on the assets are possible. Many securitization vehicles are umbrella structures and may have the risk of cross contamination. Some jurisdictions offer vehicles which offer segregation by law, however a residual risk remains as some courts outside the jurisdiction of the securitization vehicle may not accept such segregation. And the reputational risk remains in any case. Cash returns of the securitized assets such as rent, interest, royalty or repayment of capital will usually be passed on to the holders of the Notes.

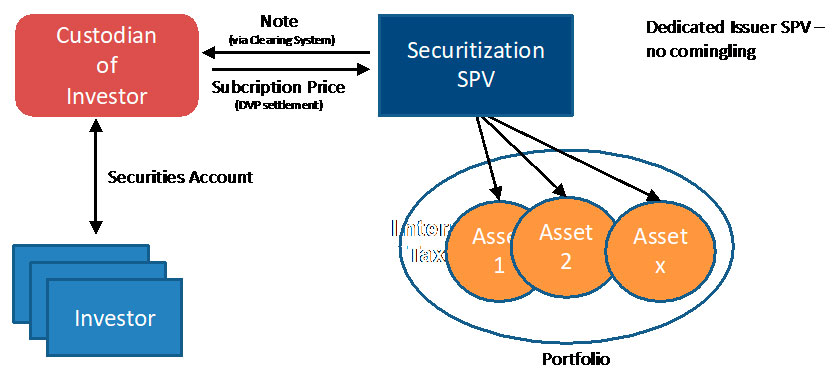

Simplified structural overview of a securitization vehicle:

2. What can I securitize?

In principle any asset. Common are property, receivables, loansand equity. Less common and more difficult to structure are art or physical assets such as machinery, warehouse goods, cars and in some instances also rights like intellectual property rights or trademarks. However securitization vehicles also have their limits so practically some “exotic” assets may only make sense in very specific setups.

3. What are the advantages of securitization?

Assets that are difficult to invest in e.g. loans, receivables ornon-listed equity can be acquired by the securitization vehicle. Paperwork to invest needs to be done only once while the end investors, who acquire the Notes issued by the securitization vehicle, receive bankable, transferable securities which can be subscribed and settled via a clearing system by any bank.

- Hence the end investor can hold the Note (and indirectly the acquired asset) via its bank and receives account statements and usual reporting. It also allows pooling of several investors who alone would not be able to participate in the securitized asset.

- In case of investments that are cumbersome to transfer such as property, the Notes issued by a securitization vehicle offer a simple transfer bank to bank via the clearing system.

- An asset or wealth manager can also include potential fees for service provided in the vehicle, where such fees are deducted directly from the securitization vehicle and no contract with the end client is required.

- Securitization vehicles are cheaper than funds and since outside of fund regulations a wider range of assets can be held compared to funds.

- This also allows an efficient way of white labelling for asset managers who prefer their own brand.

- Notes can be listed on a reputable Stock Exchange, quite common here is Vienna.

- Notes have a special regime for selling. In the EU Notes that are above Euro 125k investment, can be sold relatively freely. In Switzerland Notes, provided structured carefully, do not qualify as collective investments schemes and can be distributed under different rules.

- A very innovative add on is the option to “tokenize” the Note and prepare for future alternative settlement options.

- In a wealth management context, securitization may allow tax efficient transfer of assets while still maintaining the control or income streams over them or the efficient split of assets between different persons.

4. Where are securitization vehicles located?

The choice of location is key as clients will depend on a suitable service provider infrastructure and tax regime. Common are offshore jurisdictions such Cayman Island or Channel Island (Guernsey in particular). But recently onshore jurisdictions such as Liechtenstein or Malta gained more and more popularity. The best choice from our point of view is currently Luxembourg as it offers excellent reputation, service providers and a solid legal and tax framework within the EU.

5. What are the key things to consider?

The key question from our point of view is to carefully analyze the requirements and goals that need to be achieved. Securitized assets and the reason why a securitization is chosen are very diverse. A one fits all approach like some providers claim will not deliver the optimal result. In some cases securitizations may not even be the right format, a private fund format or a holding company may be more suitable in some instances.

Further, securitization is not a standard product. It is a very tailor made setup that requires careful consideration and experience. Depending on the goal and target market, the choice of jurisdictions is key too. Not all jurisdictions offer the same benefits. This is due to the fact that each asset is different as well as the client’s goals.. We see providers in the market that claim “individual” solutions that however always use structure and set of documents. We at Lindemann Law do not believe this can offer the optimal solution for the goal set.

We also believe that risks and suitability of underlying assets need to be carefully benchmarked versus the target investors. A securitization can and is often misused to sell assets to investors for whom such assets are not suitable. Under no means securitization should be used to “retailize” assets that are not suited for retail investors.

Would you like to set up your own securitization? – Please contact us.

We at Lindemann Law have an intensive experience and track record in securitization. We can support multiple jurisdictions and are independent of providers and format. We consult to find the most suitable structure for you instead of selling a off the shelf solution to you.

Dr. Maria Ulmann

Tatiana Zakharova

Dr. Oliver Klein

Dr. Alexander Lindemann

Dr. Ariel Sergio Goekmen-Davidoff

Martin Schweikhart

Dr. Sothy Kol-Men

Peter Vrkljan

Jörg Wenger

Thomas E. Meier

Prof. Dr. Iur. Maximilian Werkmüller