Mergers and acquisitions (M&A) in the financial sector often use auction processes to sell banks, wealth managers, or asset management businesses. While the principles are similar to other industries, the regulatory environment, client sensitivities, and relationship-driven value introduce unique dynamics. Below are the five most frequently asked questions about M&A auctions in this sector—along with practical insights for market participants.

What is an M&A auction and why is it used?

An M&A auction is a structured sale process in which a seller invites multiple potential buyers to submit competing bids. The goal is to maximize price and secure favorable terms by creating competitive tension. Unlike a one-on-one negotiation, auctions enhance the seller’s leverage and increase the likelihood of achieving the best outcome for shareholders.

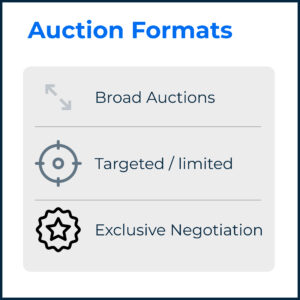

What auction formats are common?

Typical formats include:

Typical formats include:

- Broad Auction – Many buyers are invited, creating maximum competition and price tension, but increasing confidentiality risks and internal disruption.

- Limited or Targeted Auction – Only a carefully selected group of buyers (e.g., 10–50) is approached. This balances confidentiality with competition and is common in financial services.

- Exclusive Negotiation – A single buyer is invited to negotiate. Fast and discreet, but typically yields less pricing leverage.

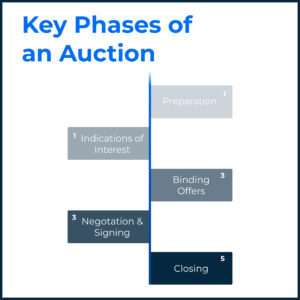

What are the key phases of an auction process?

A standard auction typically unfolds in five phases:

A standard auction typically unfolds in five phases:

- Preparation – Seller and advisors prepare a teaser, Confidential Information Memorandum (CIM), and non-disclosure agreements (NDAs).

- First Round (Indications of Interest) – Potential buyers receive the teaser and CIM, conduct preliminary reviews, and submit non-binding offers.

- Second Round (Binding Offers) – Shortlisted buyers gain access to the data room, conduct due diligence, and submit binding offers or letters of intent.

- Negotiation & Signing – The seller selects the winning bidder and negotiates the definitive purchase agreement (SPA or APA).

- Closing – Regulatory approvals are obtained and integration planning begins.

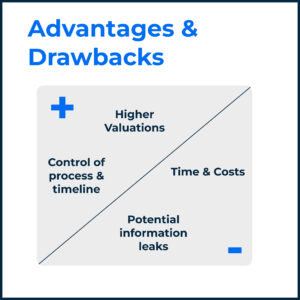

What are the advantages and drawbacks of running an auction?

Advantages for sellers

Advantages for sellers

- Competitive bidding drives higher valuations and more favorable terms.

- The seller retains control over process and timeline.

- A transparent process supports fiduciary duties to shareholders.

Drawbacks

- More time- and cost-intensive due to preparation, advisor fees, and coordination.

- Higher risk of information leaks and employee or clent disruption.

- Regulatory approvals can delay or complicate closing.

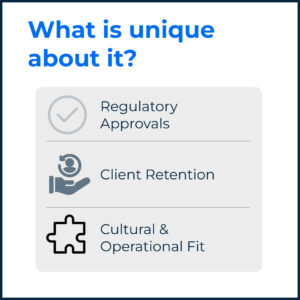

What is unique about auctions for banks and asset managers?

Financial-sector transactions introduce specific challenges:

Financial-sector transactions introduce specific challenges:

- Regulatory Approvals – Acquisitions of regulated entities (e.g., under FINMA, ECB, SEC) require extensive approvals. Certainty of execution often outweighs the highest price.

- Client Retention – The true asset is client relationships and Assets under Management (AUM). Bids may include earn-outs or retention clauses tied to post-closing AUM stability.

- Cultural and Operational Fit – Integrating relationship managers, platforms, and service models is critical to preserve franchise value. Due diligence focuses heavily on people, compliance, and systems.

Key Takeaways

| Topic | Core Insight |

| Purpose | Auctions create competition to maximize price and terms. |

| Formats | Broad, limited, or exclusive, depending on confidentiality needs. |

| Phases | Preparation → IOIs → Binding offers → Negotiation → Closing. |

| Pros/Cons | Higher valuation and control vs. cost, complexity, and confidentiality risk. |

| Bank/AM Focus | Regulatory certainty, client retention, and cultural fit drive deal success. |

Disclaimer: This publication is for general information purposes only and does not constitute legal advice. For legal advice on your specific situation, please contact us directly.